How Does Nova LifeStyle’s (NASDAQ:NVFY) P/E Compare To Its Industry, After The Share Price Drop? – Simply Wall St

To the annoyance of some shareholders, Nova LifeStyle (NASDAQ:NVFY) shares are down a considerable 84% in the last month. And that drop will have no doubt have some shareholders concerned that the 84% share price decline, over the last year, has turned them into bagholders. For those wondering, a bagholder is someone who keeps holding a losing stock indefinitely, without taking the time to consider its prospects carefully, going forward.

Assuming nothing else has changed, a lower share price makes a stock more attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that long term investors have an opportunity when expectations of a company are too low. Perhaps the simplest way to get a read on investors’ expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

Check out our latest analysis for Nova LifeStyle

Does Nova LifeStyle Have A Relatively High Or Low P/E For Its Industry?

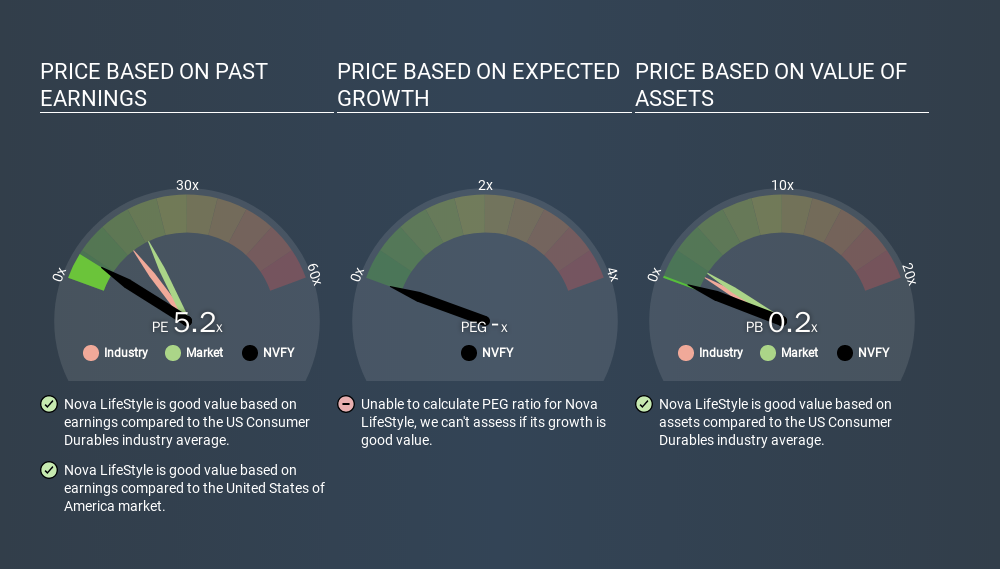

We can tell from its P/E ratio of 5.18 that sentiment around Nova LifeStyle isn’t particularly high. We can see in the image below that the average P/E (14.1) for companies in the consumer durables industry is higher than Nova LifeStyle’s P/E.

This suggests that market participants think Nova LifeStyle will underperform other companies in its industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. When earnings grow, the ‘E’ increases, over time. And in that case, the P/E ratio itself will drop rather quickly. Then, a lower P/E should attract more buyers, pushing the share price up.

Nova LifeStyle saw earnings per share decrease by 46% last year. But over the longer term (3 years), earnings per share have increased by 4.7%. And over the longer term (5 years) earnings per share have decreased 28% annually. This growth rate might warrant a below average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It’s important to note that the P/E ratio considers the market capitalization, not the enterprise value. That means it doesn’t take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting Nova LifeStyle’s P/E?

With net cash of US$1.8m, Nova LifeStyle has a very strong balance sheet, which may be important for its business. Having said that, at 16% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On Nova LifeStyle’s P/E Ratio

Nova LifeStyle’s P/E is 5.2 which is below average (18.9) in the US market. The recent drop in earnings per share would almost certainly temper expectations, the healthy balance sheet means the company retains potential for future growth. If that occurs, the current low P/E could prove to be temporary. What can be absolutely certain is that the market has become more pessimistic about Nova LifeStyle over the last month, with the P/E ratio falling from 33.3 back then to 5.2 today. For those who prefer invest in growth, this stock apparently offers limited promise, but the deep value investors may find the pessimism around this stock enticing.

Investors should be looking to buy stocks that the market is wrong about. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. Although we don’t have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at [email protected]. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more.

Let’s block ads! (Why?)