Clothing Retailers Are Finally Catching Some Breaks

The future of traditional clothing retailers has looked cloudy at best for many years now.

Department stores and specialty apparel have been pummeled by fast-fashion chains and off-price competitors such as TJX Cos. And many did a poor job of enticing consumers that, for whatever reason, just haven’t been terribly interested in loading up on new clothes.

But I have a rare bit of good news for these challenged retailers: Some of the pressure may be easing. In fact, this may be the best chance in a long time for the likes of Gap Inc. and Macy’s Inc. to reconnect with shoppers and reignite sales growth.

For one thing, as a new Bloomberg Intelligence report notes, there has been a change in momentum at clothing stores in recent months.

Out of a Rut

After a long slog of mostly declining sales, apparel stores have seen comparable sales perk up

Source: Bloomberg Intelligence, First Data

Of course, this can hardly be described as a return to glory. But it is a move in the right direction, and it seems to be powered by more than just broad-based shopper optimism. After all, consumer sentiment has been strong for some time now.

The improvement likely suggests clothing retailers lately have done a better job selling full-price goods, relying less on promotions and discounts, says BI apparel industry analyst Chen Grazutis.

A couple of things have to go right for retailers to pull that off: They need fashions so covetable that people spring for them even without a deal. And they must manage their inventory effectively so they’re not stuck trying to unload excess goods.

This has been the holy grail for specialty apparel and department stores ever since fast fashion started squeezing them: rev up supply chains and boost consumer-data capabilities to get must-have, of-the-moment clothes in front of customers.

If this pickup in same-store sales hints some retailers are finally starting to get this right, then that is seriously encouraging news for the entire category.

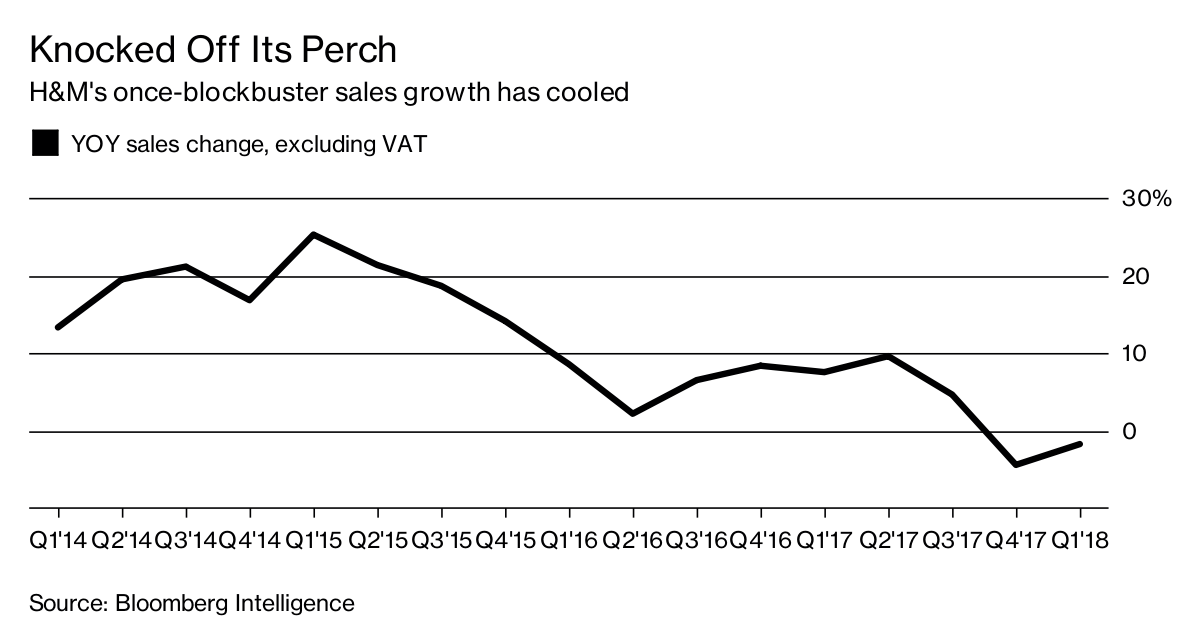

Plus, there’s a new plot twist in the apparel industry drama. Hennes & Mauritz AB, which not long ago was stomping all over U.S. clothing retailers, is suddenly looking quite vulnerable.

Gadfly’s Andrea Felsted has sounded the alarm that H&M faces big problems. It not long ago reported its biggest quarterly sales decrease on record. It has made fashion missteps and is grappling with bloated inventory.

Knocked Off Its Perch

H&M’s once-blockbuster sales growth has cooled

Source: Bloomberg Intelligence

Once-mighty H&M is not at the top of its game right now, and department stores and specialty clothing players should take full advantage of the chance to siphon off its customers.

There is one more opportunity these troubled chains can seize: Fashion is in the early innings of a massive aesthetic change.

Yes, many trends have come and gone at warp speed in the past decade or so, but the dominant silhouette — flowy tops, skinny jeans, boots pulled over the jeans — took hold around 2006. Until that uniform went out of style, women just didn’t have an urgent reason to replace their clothes.

An era-defining shift is finally underway. High-waisted pants are everywhere, notes BI retail analyst Poonam Goyal. Tops have gotten shorter to go with them. Skinny jeans are giving way to wide-leg or cropped straight-leg pants. Riding boots have been dumped for ankle booties or loafers. Shoppers are tiring of athleisure-mania.

This new look is boosting Urban Outfitters Inc.’s sales growth, CEO Richard Hayne told investors in March. He said the pants silhouette shift has driven “excellent” comparable sales growth in UO’s “bottoms” category.

The rest of the specialty-apparel and department-store world can also benefit from this sartorial pendulum swing. It’s a great chance to reawaken the interests of lapsed customers who have been on the fashion sidelines.

I’m not saying apparel retailers are on Easy Street now. Consumers will keep pouring money into experiences such as travel and dining out, leaving less cash for clothes. Mall traffic will still be spotty, and Amazon.com Inc.’s growing offering of private-label clothes is a new challenge.

But chains from J.C. Penney Co. Inc. to J. Crew Group have new tailwinds to help them mount a comeback. The spoils will go to the stores that best take advantage of these conditions.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Let’s block ads! (Why?)